Category velocity

People make decisions, not businesses. And, the same people who stand in-line for limited edition sneakers, use GoodRX coupons for their prescriptions, buy travel protection on their United flight, and Prime a couple hundred different items in preparation for having a baby also are making decisions about what software their company should use.

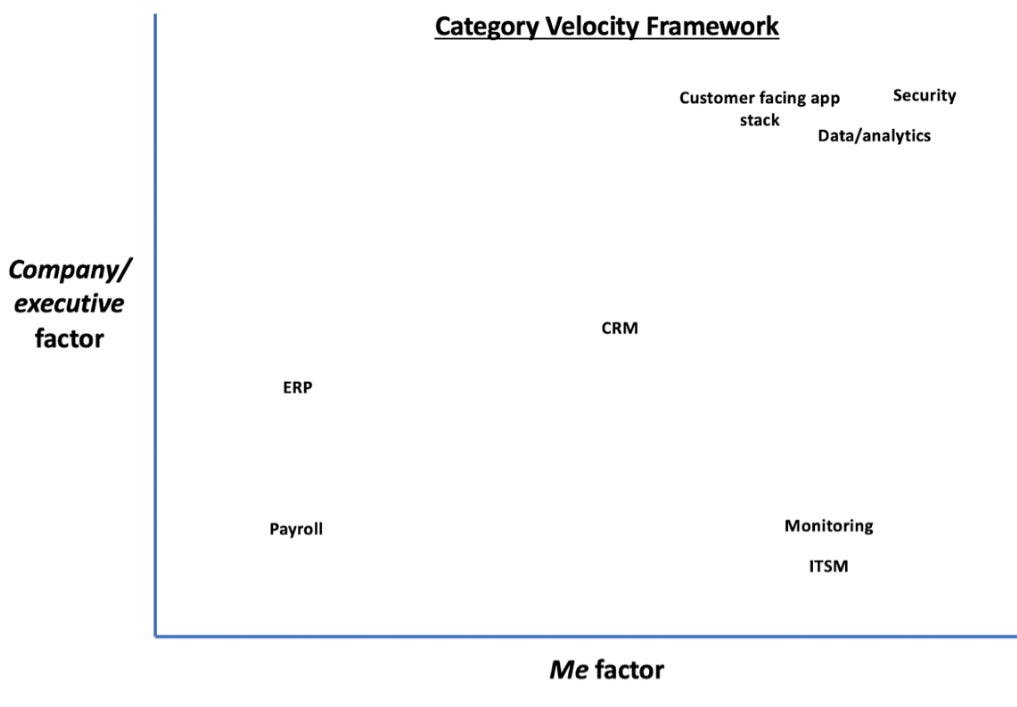

I say the above because, like consumer purchase decisions, software purchase decisions often come with their own peculiar rationality. I like to think about business (particularly corporate) decision making along two dimensions. The first dimension is the me dimension, as in what’s in it for me as the decision maker/advocate/champion. Fear is a common motivator on the me axis: fear of losing a job, anxiety about not getting promoted, stress from having to work longer hours, worrying about failing teammates, etc. Status is also a motivating factor - resume building, promotion potential, certifications, expertise on a new technology, etc.

The second dimension is the company or executive dimension, or what aligns with company level initiatives. These initiatives are usually driven by executives, so I use company and executive interchangeably. Again, fear is a common motivator: fear of falling behind competition, eroding customer trust or brand value, missing targets, losing talent, share price decline, etc.

If you put these two dimensions together you can better understand category velocity. An example of a category with high velocity is security. If there is a major security breach, then you might get fired as a CISO or a security admin. That is a major me motivator. Additionally, that same breach might cause significant brand damage and lost revenue due to pissed off customers (see Solarwinds and Equifax). So there is also significant company motivation. New threats are always emerging, so security is nearly always a focus. If you have ever sat in on a board or risk committee meeting, you know this to be the case.

Shopify is in a high velocity category because their tools directly drive revenue. And, maybe more importantly, the me and the company are often almost perfectly aligned due to the number of sole proprietors and small businesses in Shopify’s end market.

An example of a category with low velocity is payroll. While there is major risk if you can’t figure out how to pay your employees, it is hard not to figure it out. The category is mature and there are a lot of resources available to help you not screw it up. Payroll is almost never a top-level executive priority, except maybe at the startup stage.

There are categories with higher me velocity but low company velocity. Most tools fall into this category. Smartsheet might be great for a project manager to adopt as it will help them execute some project more effectively. But rolling out Smartsheet almost never has company level urgency. The same is true for an application monitoring solution, unless maybe the application being monitored is something like Walmart’s Grocery Pickup app, i.e. a company level priority that can’t fail. ITSM falls into this category - your job as an IT person will be less stressful if more things are automated and it is best practice to implement modern ITSM (thus good for your career to do it), but the board will not care. Your CEO probably has no idea what ITSM means.

Less common are categories that have very low me velocity but higher company velocity. An ERP implementation is a good example. It might be a company priority to implement an ERP for various reasons. But, most individuals know ERP implementations are time sucks with little upside and lots of downside. There is probably higher career risk if you implement an ERP than if you don’t. This is why ERPs are great for consultants, as the people involved will want someone else to blame if something goes wrong.

Tuning your business to the category velocity

As a management team, you need to be realistic about the velocity of your category. And you need to tune your business to that velocity.

If you are in a high velocity category then you probably need elite talent because customers will pay up for the best product (so they don’t get fired). You also probably need a lot of funding to hire lots of salespeople because the market will become available very quickly. Your multiple (and thus your cost of capital) will be driven by how fast you are growing and the likelihood that you become the #1 or #2 player.

The same playbook won’t work in a low velocity category. You may have a great account reconciliation software tool, but automating account reconciliation is only going to be a priority for a relatively small number of accounting folk in a year. And it will never be a company-level priority. So if you hire a bunch of sales reps and spend a bunch of money on marketing, you will likely end up destroying shareholder value rather than creating it. And if you hire the best front-end engineers to make your tool smoother than butter you are also probably destroying value.

Good management teams in low velocity categories understand the above. Ultimate Software famously only grew AE headcount by 5 to 10 percent a year. Why? Because the payroll/HCM market only moves so fast. It was better to retain great AEs than chop up territories and churn reps every year. Ultimate was also based in Florida and hired C-tier engineering talent. It worked!

Rather than tune for growth, low velocity teams tune for longevity. They locate talent in lower cost regions rather than higher cost regions. They invest heavily in customer satisfaction. They optimize for margin expansion alongside growth in order to keep the cost of capital low and the share price up. Really they just grind away. Consistency of execution matters most in low velocity markets.

Capital abundance and category velocity

Capital is a necessity in high velocity categories. But, when capital is abundant (as it is now) money will flow into low velocity categories. This forces companies in low velocity categories to act like they occupy a high velocity category. This is happening in finance tools today because some VCs saw long-percolating low velocity companies like Blackline, Workiva and Anaplan have some success after a decade-plus in the mines. So now money is flowing in, big goals are being set, lots of cold emails are being sent to mid-level accounting and finance folk, and lots of reps won’t make quota. This is what happens when too much capital flows into a low-velocity category.

Startups and category velocity

Venture backed startups and growth stage companies generally have a higher velocity for everything they do. This is because employees are incentivized to move quickly and “build for scale.” There is more me and company urgency. This is why low velocity categories like corporate credit cards or employee onboarding tools can be higher velocity if focused on startups.

Competition and category velocity

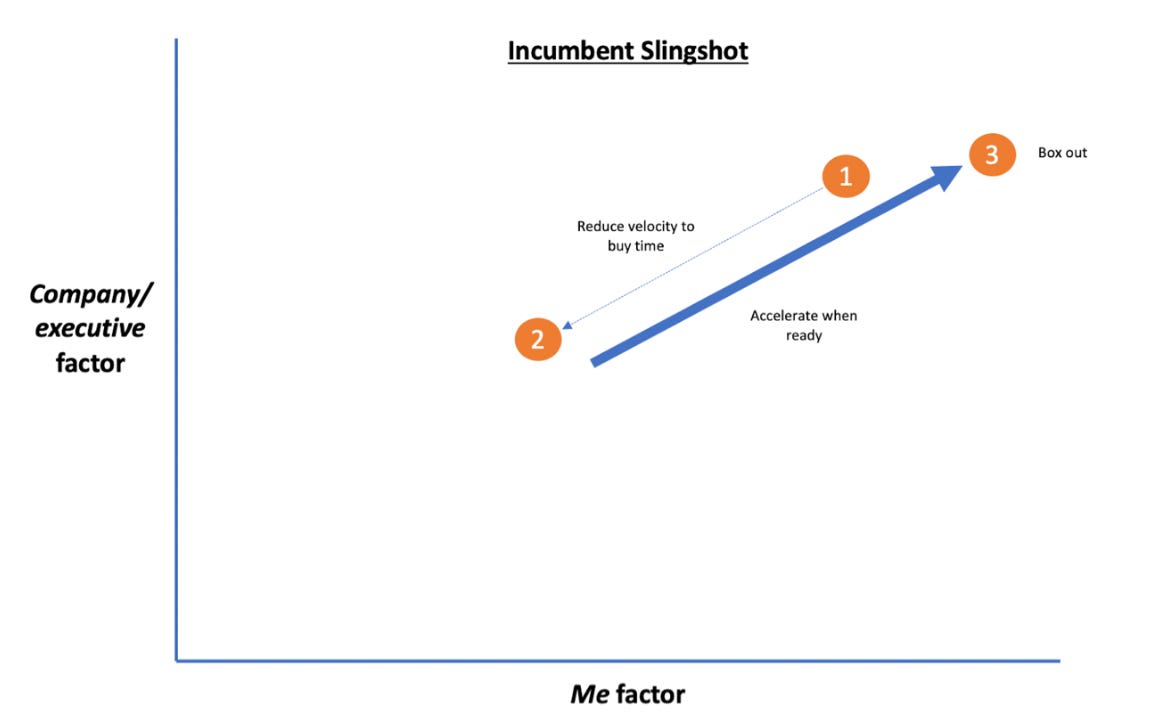

Incumbents almost always want to slow the velocity of a new category at first. This is usually done by effectively paying customers to wait a bit via discounts and incentives. Sometimes it is done by playing the security card - “x is not enterprise grade”...that’s right, you might not get promoted if you rush into this and there is a security or compliance issue down the road. Major me bummer. Other times it is done by selling an even bigger and more compelling vision than the category offers on a standalone basis - “imagine file sharing, but in every application.”

Once the incumbent is 80% of the way there, they accelerate the velocity of the category to saturate the market and box out the best of breed challenger. I call this tactic the slingshot. This is Microsoft’s business model.

Sometimes a relatively low velocity category suddenly becomes a higher velocity category. RingCentral has operated in a relatively low velocity category (cloud phones) for a long time. The company was perfectly tuned for its end market. Now cloud phones are becoming a high velocity category because they are being bundled into video conferencing solutions and video conferencing is a high velocity category.

A shift in velocity is not always a bad thing. ZoomInfo has historically occupied a low velocity category and has played the role of a consolidator. As digital-first sales techniques have become best practice and the B2B software industry has grown, ZoomInfo’s category suddenly became higher velocity.

Time and category velocity

As categories mature they typically lose a bit of their velocity. ERPs were once a high velocity category. But now most companies have implemented one and as mentioned above there is limited career upside to implementing an ERP. This was not the case in the late 1990s.

Security and data are permanently high velocity categories, though sub-categories can lose their velocity (e.g. firewalls).

Marketing and category velocity

One job of marketing is to change category velocity. CEOs with great marketing instincts (e.g., Benioff) have an innate sense of how to accelerate both company and me velocity. Great marketing organizations (e.g. Microsoft) are world class at decelerating both company and me velocity, then suddenly accelerating both when the time is right.

Investing and category velocity

Using the category velocity framework is highly subjective. But you can suss out buyer motivations by talking to customers and partners. And it is helpful when evaluating the sustainability of growth. Below are a few examples of things I look for:

Does the management team have a realistic view of category velocity

Does the business model, culture, talent level, and org structure fit the velocity

Is there acceleration optionality? If the velocity were to suddenly accelerate, would that be a good thing or a bad thing?

Is high velocity in one segment of the market (e.g. the technology industry) creating false signal as to what the velocity is elsewhere

Is there risk of an incumbent slingshot?

Interesting. I live in SF/Rincon Hill and have been investing in software and internet for over a decade. Would you like to grab a coffee sometime? cheers