Explaining the growth software sell-off

The terminal value double whammy of rising interest rates

This week I caught up with an old friend who is an equity salesperson. The conversation turned to the market and she asked an interesting question: “I heard that every 50bps increase in the 10-year should cause a 15% contraction in SaaS stocks, do you think that is true?”

The short answer is that something in that ballpark sounds about right. Growth stocks are very sensitive to changes in cost of capital. In this post I’ll discuss:

How the average market participant values SaaS stocks and incorporates the risk free rate into their analysis

The terminal value double whammy: The impact of changes to the risk free rate to how an average market participant will value a SaaS business

Briefly, the impact an increased cost of capital can have on fundamentals.

Quick note: if you made it this far you might interested in subscribing to my substack. I’m an analyst mostly focused on the SaaS industry. I’ll post ~weekly with something similar to the below. Once a month a I’ll do a deep dive on a company. The first deep dive (SNOW) will be free. Others will be behind a paywall.

SaaS investing is all about the terminal value

Most SaaS ownership is concentrated in hedge funds and a few very large mutual funds (T Rowe Price, Fidelity, etc.). In each of these funds, there is a portfolio manager who made the buy decision and an analyst (or team of analysts) responsible for making buy or sell recommendations.

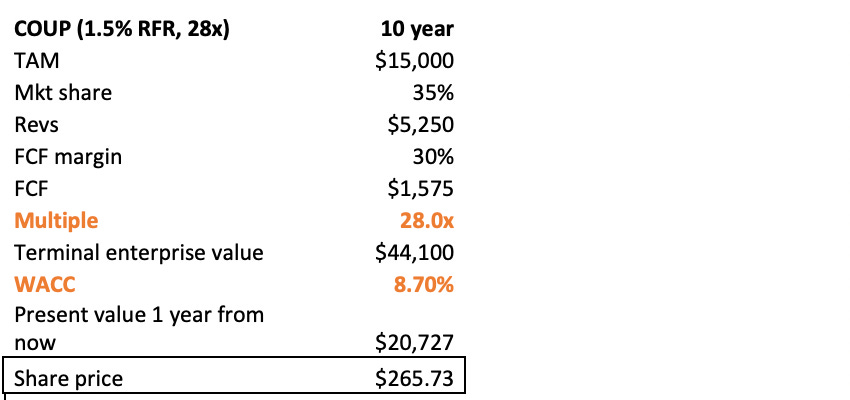

In building a pitch, an analyst is taking into consideration two questions: what is the fundamental outlook for this business and what will the market pay for it? Most growth investing conversations boil down to a debate about what a company can look like in 5 to 10 years. A simple framework for a stock like COUP (a procurement software company) might be something like the below:

The fundamental outlook is the fun stuff like market size, competition, management, margin structure, etc. To arrive at a fundamental POV, an analyst might spend weeks talking to competitors, customers, and industry experts. She might attend conferences and use the product. In the above framework, the analyst has taken the view that COUP will do $5B of revenue in 10 years with 30% free cash flow margins. This is the output of all of the fundamental legwork.

Establishing what the market will pay for a stock it is a mix of art and science. Here is where DCFs and comparable analysis come in. For the COUP hypothetical above I’ve used a very simple valuation framework that focuses on the terminal value of the business. One thing I’ve learned over the last decade-plus is that growth investing is all about the terminal value. That is because cash flow generated over the next decade for most growth businesses tends to be a very small percentage of the equity value (particularly when accounting for dilution). There are exceptions here, but for the most part growth investing is all about the terminal value!

In the above framework the hypothetical analyst has used a 40x NTM FCF multiple to derive the terminal value and a WACC of 7.7%, based on a 0.5% risk free rate to discount it back.

The terminal value double whammy

When there is a major change in the risk free rate, fundamental investors can be caught flat footed. Put yourself in the shoes of a PM or analyst that owns SaaS stocks. You own a portfolio of companies. They are doing well and the stocks have worked amazingly well over the last year. Nothing has changed fundamentally. In fact, things might be getting better coming out of the recession. Why would you make changes?

But, the market is a complex beast. And at the margin, as rates start to change certain participants react quickly. Quantitative and macro funds that trade baskets of stocks based on major macro signals, as an example. This triggers a change in momentum. Suddenly everyone is reevaluating what they own because stocks are down 10%. That is where we have been over the last month. Every professional investor is reevaluating what they own right now.

Again, the fundamentals have not changed much over the last few months. But, the risk free rate has increased. This is changing what the market will pay for stocks throughout the growth curve. The very top down and simplified view is that the “cost of capital is going up.” But, how does that have such an outsized impact in such a short period of time?

The answer is that growth stocks in particular face a terminal value double whammy when the cost of capital goes up.

Whammy!!: Terminal value per share is worth less due to higher discount rate

Let’s dive in, starting with the most obvious point where the cost of capital impacts valuations: the discount rate.

As analyst you are taking a look at your models and updating assumptions. First, you update the WACC to reflect an increase in the risk free rate. Your portfolio manager is now very paranoid about inflation and rates overshooting, so instead of 1.5% (where the 10-year is currently) you use 2% as the risk free rate.

Ok, wow. COUP is already worth 11% less than you thought it was a few months ago just because of a change to the discount rate used to bring the terminal value back to today.

Whammy!!!: Multiples are compressing, driving the terminal value lower

But there is a bigger impact flowing through everyone’s models this coming week: Terminal multiples are compressing.

Again, you are the analyst. A core part of the pitch to you PM is what the market will pay for COUP at the end of your forecasted period.

There are a couple of ways to figure this out: a theoretical approach and a more practical approach. Let’s start with the practical approach, which is to look at comparables

The most intuitive way to find a price for anything is to see what other things like it are selling for. This is true for houses (price/sf in a neighborhood), for sneakers on eBay, and for stocks. In this case though, as an analyst you are looking at what people will pay for a business that looks like COUP in 10 years – high teens revenue growers with healthy cash flow margins.

In your original analysis justifying the purchase price of COUP, you settled on a composite of CRM and ADBE – high teens growers with FCF margins that averaged out to about 30% with EV/NTM FCF multiples of around 40x.

Fast forward to today: like with COUP, the market is repricing the value of CRM and ADBE to reflect a higher discount rate and a lower terminal multiple. That has driven a 10-15% decline in share prices for each from when you did your original analysis. The 40x now becomes 35x.

So, now due to a change in the cost of capital and its corresponding impact on the discount rate and the terminal multiple, COUP is now worth 20-25% less than you thought it was.Across the market, there are thousands of market participants doing a similar type of analysis and repricing everything they own. This is the ripple effect we are observing.

Theory takes a similar view of COUP. What is a multiple? Well, I was taught it is 1/(cost of equity capital - the perpetuity growth rate). A multiple is an encompassing view of cash flow generation forever. Because of the duration reflected by a high multiple, small changes have big impacts.

1/(cost of capital-perpetuity growth) = 1/(7.7%-5.1%) = 40xWhat if we bump the risk free rate up by 100ps to 1.5% (the current 10-year yield).

1/(cost of capital-perpetuity growth) = 1/(8.7%-5.2%) = 28xToday COUP is at $285, or about 10% above the theoretical price target. Again, this is all more art than science. But the core conclusion should be that when you are dealing with big numbers way into the future, small changes to the cost of capital have big impacts.

This is true both on the way up and the way down. The massive multiple expansion over the last year in SaaS has largely been driven by the risk free rate being cut from 1.9% to 0.6% with a consensus view for many months that it could go lower. COUP, as an example, came into the COVID valued at $167. The company has grown 35% over the last year with no real change on the consensus view of durability of growth or LT margin potential. So, all else equal we would expect the stock to be at ~$225 today with no change in the risk free rate. Keep that in mind as you start to think about where we are in this correction.

Increased cost of capital impact to fundamentals

I’ve mostly stayed away from the impact of market pricing on fundamentals. Most folks think of fundamentals as impacting market price, but market price can also impact fundamentals. The cost of capital for SaaS is going up (though still low). This creates an impact on multiple fronts:

Hiring – The market price for great engineers is set by large cap tech, which will have less volatile share prices. Additionally, more shares are required to fund an equivalent equity grant (on a $ basis) vs a copule of months ago. This increases the cost of growth.

M&A – Equity currency is worth less, so more dilution is required to accomplish the same deal.

Customers/Partners – When your stock is always going up it creates buzz and momentum in the industry. It also creates great marketing opportunities on CNBC and Fox Business! If your stock is trending down and to the right, the FOMO of a new technology can fade.

These impacts are at the margin, but another factor to keep in mind.