The Software Slog

As a newly minted high school grad I had a brief stint as a wildland firefighter. Part of training for the job was a timed 10-mile walk with a 60-pound pack. It was on a high school track in early June in Montana. And it was a slog.

Running 10 miles is painful, but it goes by relatively quickly and there is a rush of accomplishment at the end. Hiking 10 miles can be tiring, but there are views and trees and stuff. But this was boring, exhausting, and progress inched by. At the end there wasn’t really a sense of accomplishment - after all, we had just walked around a 400m track for 4.5 hours.

I fear the software industry is settling into its own version of a slog: an extended period of low returns and slower growth where wealth creation feels hard. A 40 laps around a high school track sort of slog.

Hope Springs Eternal

I hope I’m wrong and writing this from the nadir of sentiment. But, it would be weird if this were the bottom.

Greenoaks just cut a $500M check to Rippling at an $11.25B valuation. There isn’t really a justification for this price unless you are betting on mean reversion to the 2019-2021 period (which would be mean reverting to the second standard deviation, but I digress).

Wiz just raised another $300M at a $10B valuation from Greenoaks and Lightspeed. Again, limited justification for this price unless deep down you are holding out some hope of multiple expansion or have resigned yourself to 10% IRRs.

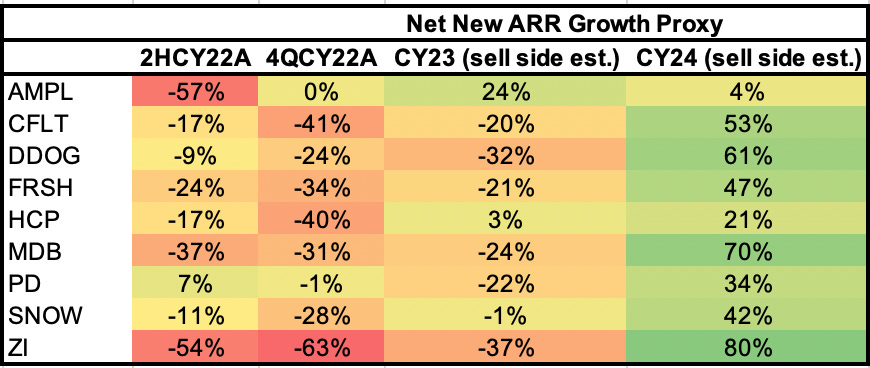

Public SaaS estimates also have a lot of hope in them. The below table highlights my estimate of net new ARR bookings for a handful of public SaaS companies. Consensus is betting for a sharp rebound in CY24 after 5-6 quarters of slow growth.

Consensus is modeling a rapid rebound in SaaS growth

Which historical analogue?

Implied in consensus estimates is a GFC-style crash-and-rip resolution to SaaS’s current malaise. As an example, during the Great Financial Crisis, Salesforce growth decelerated for 7 quarters before sharply accelerating in calendar year 2010.

This might happen. But, consensus rarely calls for an out-year rebound in growth at the bottom (as estimates do for SaaS now). In the second quarter of calendar 2009 out-year billings growth estimates for CRM were ~15%. Few saw the light at the end of the tunnel.

Additionally, the starting conditions were different versus today. Coming out of the GFC the cloud was at the knee of the curve. SaaS penetration was near zero. Enterprises had barely dipped their toe in the water. The conditions were ripe for a rip.

There is another historical analogue that seems closer to our current reality: software in 2000-2003. Like then, the software industry has just exited a period of orgiastic software spending. Rapid growth in the startup ecosystem, the move by corporates to the cloud, and what appears to be a cycle peak in corporate growth/profitability all coalesced to create a 1999/Y2K-like surge in software spending from 2019-2021.

These surges can have extended hangovers: after peaking in 2000/2001, industry license revenue (the on prem equivalent to net new ARR) was basically flat-to-down for 3 years. There was some value creation from the bottom via financial engineering and M&A. But there was no reversion to 2000 levels of bookings. It was a slog.

Growth doesn’t rebound in a slog

Zombie SaaS

I’ve been reading a great book by Edward Chancellor called The Price of Time. The book goes deep on the history of interest rates and related credit bubbles/crunches.

One theme from the last 30 years or so is the prevalence of “zombie” companies after a credit cycle. Zombies in this context are firms that are economically unviable. But, to avoid write-offs, creditors often refinance the debt of these companies to sustain their existence. Zombies are bad for an industry, because they are a drag on growth and raise the cost of capital for other competitors in the market.

There is a version of this in the SaaS industry. Zombie SaaS are kept alive by the oversized rounds of 2020/2021 and by the oversized venture capital funds raised in that period. The amount of money still on the balance sheets of VC-backed corporates and VC funds is underappreciated. And, while VCs will likely only continue to fund their “winners”, winners are not evenly distributed across portfolios. The winners in most VC portfolios are destined for mediocre outcomes.

So much fucking money (aka Zombie fuel)

Zombie SaaS erodes the return potential of non-zombies. They are competitors for talent and for customers. And, to create some semblance of momentum, zombies use price as a lever for survival. Due to this, zombies can create more zombies.

This is already happening in the mid-market segment of SaaS. Best of breed solutions are fending off smaller competitors desperate to stay alive and show some traction. These competitors have become hyper aggressive on price, attempting to capitalize on VC backed companies everywhere tightening budgets.

Price wars aren’t fun. Fending off zombies isn’t fun. Slogs aren’t fun.

Zombie Headcount

There is a fractal element to this. Capital is misallocated at the industry level, which pulls down industry returns. Capital is also misallocated at the corporate level, creating a further drag on returns. Both contribute to the slog.

Most of the investment by software companies (usually about 70% of operating expenses) is in people. And so much of the hiring of the last two years was made in anticipation of net new ARR growth continuing in a linear or superlinear fashion. Marketing leaders added field coverage in low return geos (APAC, continental Europe). CROs built out large sales operations teams to support anticipated doubling and tripling of sales orgs. Product leaders stood up teams focused on entering adjacent categories. Business development leaders were hired (often despite a lack of partner inbound interest) and they in turn built out large partner teams. Most of this headcount is zombie headcount - not productive and sustained by management teams not ready to write them off.

RIFs have been the rage over the last 6 months. Investors have cheered them. But, excluding a handful of exceptions, most of the layoffs have cut headcount back to Jan 2022 levels at best. They have trimmed underperformers, but for the most part have been superficial. The reason for this is hope. Hope of reacceleration. Most private company plans have growth accelerating in 2H or in CY24. And to be fair, I would have the same plan! You don’t get rich on the back of rapidly decelerating growth. Instead you play for the turn.

But growth doesn’t really accelerate in a slog. So, more layoffs are likely.

Investing through this cycle

Well, that was bleak. Again, I hope I’m wrong. It is hard to make money in a slog. Maybe AI is a catalyst. We’ll see.

My approach here is to avoid mid-market exposure (zombies), avoid workflow tools (zombies), and avoid overly optimistic consensus estimates. I treat everything as range-bound and no one as immune to a slowdown. Best positioned are systems of record that can generate FCF and consolidate features over the next three years.

Can you speak more to the part about midmarket/workflow companies/tools in the last paragraph?

The best counterexample I can think of is ServiceNow - which is doing really well despite being a workflow tool (even saw you recommend them the other day on Twitter)

Why do you consider mid market to be zombies?